Once you are enrolled in the French Healthcare System, your next step is to find the best mutuelle in France. This guide explains how to find the best mutuelle in France for your needs. You will learn how to decrypt a mutuelle’s benefit chart and how to calculate your reimbursements.

Disclosure: This site is sponsored by ads and affiliate programs. I may earn money from the companies mentioned in this post.

What is the best mutuelle in France?

The best mutuelle santé is a supplemental health insurance adapted to your needs. The best mutuelle for a student is probably not the best one for someone over sixty, or for a family with small children.

If you are not sure whether you should subscribe to a mutuelle santé, first read Four Reasons to get a Mutuelle Santé.

How to choose the best mutuelle in France?

To pick the right mutuelle:

1. Contrat responsable (Responsible contract)

Make sure the mutuelle santé is contrat responsable. Contrat responsable gives you access to 100% Santé.

2. Pick a plan based on your family’s needs

Ask yourself:

– Do you or a dependent wear glasses?

– Do you often see specialists non conventionnés? (Assurance Maladie does not cover visits to doctors non conventionnés)

– Do you or a dependent need dental prosthesis?

– Do you have teens who might need orthodontic treatments any time soon? Try to anticipate your needs in the near future.

– Who is going to be on your plan? Is it more advantageous to subscribe to one plan for the whole family or to pick several plans?

These are the questions that guide your choice of a mutuelle plan.

How to find a mutuelle in France?

The cotisations (premiums) for a mutuelle santé are based on your location, age and family situation. That is the reason why you need to enter your personal information before you can get a quote. The good news though is that you do not need to enter any health specific information. To find a mutuelle, use an online comparison website.

Use a mutuelle comparison website

There are multiple Mutuelle online comparison websites that can help you find a mutuelle santé from Mutuelle organizations and insurance companies (not banks). Les Furets is my preferred one.

All online comparison websites work pretty much the same way and I’ll walk you through the questionnaire from Les Furets. You always start by entering your basic information.

1. État civil (Basic Information) and family members

Enter the name, gender, date-of-birth and address of each family member on the mutuelle plan.

Next, enter the family members you want on your plan.

2. Régime social (Work status)

Specify the work status of each adult on the mutuelle plan.

3. Coverage preferences

Specify your health coverage preferences.

List of results

After you fil out your information and preferences, the comparison service returns a list of Mutuelle organizations and insurance companies that satisfy your requirements. As you can see in the following result list from Les Furets, most mutuelles santé are contrats responsables.

To see a benefit chart of a specific mutuelle santé, click on Plus de détails.

Be aware that you will receive some phone calls if you enter your phone number in the comparison tool. I suggest that you enter a fake phone number if you are not ready to make a decision just yet.

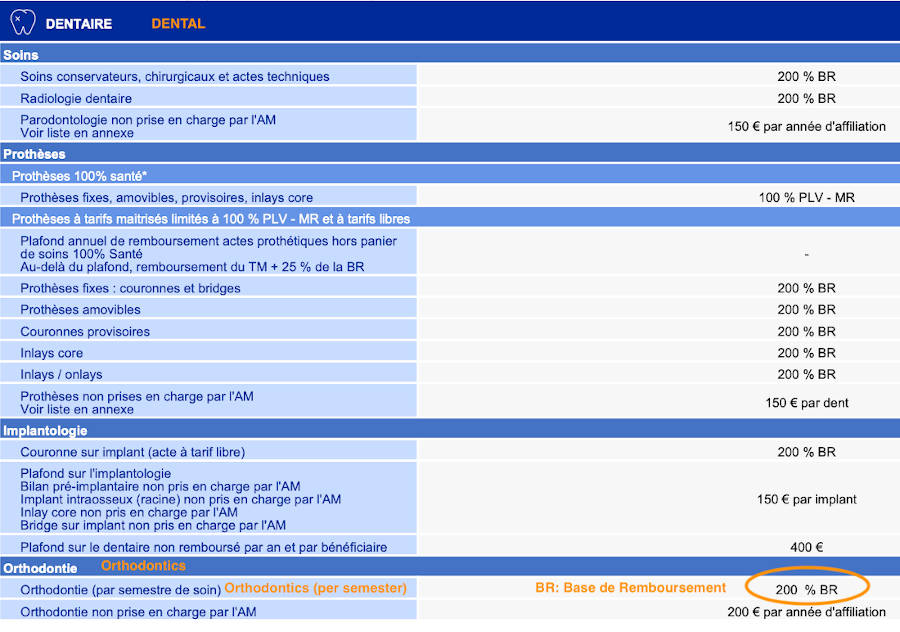

Mutuelle benefit charts explained

Each insurance company, bank or Mutuelle organization provides different levels of coverage. Dental, optic and auditive care are the most pricey medical expenses and they are better reimbursed with higher mutuelle levels (and higher premiums).

I’ll use the following abbreviations to make this article easier to read:

- AM: Assurance Maladie

- BR: Base de remboursement

- TR: Taux de remboursement

To select a mutuelle adapted to your needs, take the time to consult the tableau de garanties (benefit chart) in details. The benefits are usually presented in a table organized in four or more sections:

- Soins courants (routine healthcare)

- Hospitalisation (hospital)

- Dentaire (dental)

- Optique (optic)

In a benefit chart, each line displays a type of medical service and its corresponding garantie (coverage) as:

- a percentage called taux de remboursement TR (reimbursement rate). This is not the same taux de remboursement as the one from from Assurance Maladie because it includes reimbursements from Assurance Maladie and mutuelle.

- a fixed amount in euros

- frais réels (real cost)

Here’s a typical routine healthcare section:

The first line means that you get reimbursed 250% of base de remboursement (BR) when you see a generalist or a specialist who is part of Dptam. Your reimbursements are 200% of BR for a physician outside Dptam. I show you how to use these figures to calculate your reimbursement a few paragraphs down.

What are Dptam and Optam?

Dptam is a network of doctors in secteur 2 who have signed an Optam contract with Assurance Maladie to keep their fees reasonably low. In exchange, Assurance Maladie reimbursements for a visit are the same as for a secteur 1 doctor.

Optam-CO is Optam for chirurgie (surgery) and obstétrique (obstetrics).

When checking out a mutuelle rate, you often see better reimbursement rates for physicians inside the Dptam network.

Taux de remboursement (Reimbursement rate)

Understanding taux de remboursement allows you to calculate how much you will be reimbursed. If you are not familiar with base de remboursement (BR), read French Healthcare System first. There are three important concepts to understand about taux de remboursement.

1. Taux de remboursement is a percentage of BR

A mutuelle’s taux de remboursement is a percentage of base de remboursement (BR), which is set by Assurance Maladie. Your reimbursement is not based on the actual cost of the medical procedure.

Base de remboursement for some medical procedures is a lot lower than the actual medical expense. This is particularly true for orthodontic treatments. When base de remboursement is way lower than real costs, you need a taux de remboursement of 400% BR to even come close to be fully reimbursed.

When you visit a doctor who charges more than tarif de base, a 100% BR taux de remboursement does not reimburse dépassements d’honoraires. If you frequently visit doctors who charge dépassements d’honoraires, pick a mutuelle with a taux de remboursement of at least 200% BR for generalists and specialists.

Doctors in secteur 1 charge tarif de convention, which equals base de remboursement. In that case, if your mutuelle’s taux de remboursement is 100% BR, your out-of-pocket is 1€ participation forfaitaire (never reimbursed in contrats responsables). For doctors in secteur 1, 100% BR is the best reimbursement.

2. Taux de remboursement includes reimbursements from Assurance Maladie

Taux de remboursement is the percentage reimbursed to you by Assurance Maladie and mutuelle combined, not your mutuelle only. In other words, the figure on your mutuelle’s benefit chart includes the part already reimbursed by Assurance Maladie.

When taux de remboursement is 100% and Assurance Maladie already reimburses 70%, your mutuelle reimburses the remaining 30% of the bill.

3. You cannot receive more than you paid

Taux de remboursement should be read as “up to”. You can never be reimbursed more than you paid.

100% taux de remboursement means that you will be reimbursed up to 100% of base de remboursement.

How to figure out base de remboursement (reimbursement rate)?

Most percentages on a mutuelle’s benefit chart are based on base de remboursement (BR) from Assurance Maladie. You can find base de remboursement on Ameli (Assurance Maladie website).

Run the numbers

Now that you understand base and taux de remboursement, let’s dive in. The calculation to find your reimbursement amount from Mutuelle and Assurance Maladie combined is as simple as:

Your Reimbursements = BR * TR - Participation forfaitaire

The most tricky part is finding BR for a given medical service and this is relatively easy on Ameli. I am now going to give you examples of how to calculate your reimbursements for various medical services.

Example 1: visit to your médecin traitant, who is in secteur 2 within Dptam.

On Ameli’s Vos remboursements page, you see that base de remboursement (BR) for Généraliste adhérant à l’option de pratique tarifaire maîtrisée (Optam) inside Parcours de soins coordonnés is 25€.

For a 50€ visit, your reimbursement from Assurance Maladie and mutuelle combined is:

- 24€ (25*100% – 1) for 100% TR

- 49€ (25*200% – 1) for 200% TR

Notice that picking a 100% or 200% TR makes a big difference in your out-of-pocket for a doctor who charges dépassement d’honoraires (amount above official fee).

Example 2: visit to your médecin traitant, who is in secteur 1.

Tarif de convention (official fee) is 25€ for a doctor’s visit inside parcours de soins coordonnés. Tarif de convention is the same amount as base de remboursement. For a doctor’s visit, your reimbursement from Assurance Maladie and mutuelle combined is:

- 24€ (25*100% – 1) for 100% TR.

Notice that for a physician in secteur 1, 100% TR is plenty and you do not need a higher rate.

Example 3: visit to an ophthalmologist, who is in secteur 2.

On Ameli’s Vos remboursements page, you see that base de remboursement (BR) for Ophtalmologue secteur 2 is 23€. As a side note, you do not need a referral from your médecin traitant to see an ophthalmologist.

For a 70€ visit, your reimbursement from Assurance Maladie and mutuelle combined is:

- 22€ (23*100% – 1) for 100% TR

- 45€ (23*200% – 1) for 200% TR

- 68€ (23*300% – 1) for 300% TR

Notice that which mutuelle’s plan you chose can make a big difference when you visit a specialist who charges dépassement d’honoraires (amount above official fee).

Frais réels (Real costs)

In your benefit chart, it sometimes reads Frais réels instead of a percentage. Frais réels means that the insurer reimburses all your medical costs, except for participation forfaitaire.

Case study: the best mutuelle for orthodontics

Most people look for a mutuelle without any specific medical need in mind. Sometimes though, you know exactly what medical procedure you need covered. This is the case when your teen needs braces for instance. Orthodontics is poorly reimbursed by Assurance Maladie and you need to make sure you get reimbursed by a mutuelle.

Because it is easier to understand how things work with a down-to-earth example, I will share my experience of shopping for a mutuelle santé to cover the expenses for my son’s braces. You can apply this case study to any specific medical costs that requires a good coverage from your mutuelle santé.

1. Assess your needs and situation

Before starting any work, the medical professional (the orthodontist in my case) gives you a quote which lists each treatment with the part reimbursed by Assurance Maladie.

Without a mutuelle santé, my out-of-pocket expenses would be 3,882.50€ for five semesters. Fortunately, I do have a mutuelle with 140€ premiums per month for a family of four. My current mutuelle plan reimburses 200% per semester for orthodontic treatments.

To calculate my reimbursements, I need to know base de remboursement (BR) (reimbursement basis) for orthodontic treatments. I found BR for orthodontics on Le remboursement des traitements d’orthodontie from Ameli.

I can now calculate my out-of-pocket for orthodontic treatments with my current mutuelle.

| Orthodontic cost | 970€ |

| BR | 193.50€ |

| Total reimbursements (BR * 200%) | 387€ |

| Out-of-pocket | 583€ |

| Premiums (140€ * 6) | 840€ |

| Total expenses (Premium+out-of-pocket) | 1,423€ |

When I picked this mutuelle santé four years ago, I did not need orthodontics coverage. Since my plan is more than a year old, I can cancel my plan at any time and start looking for a new mutuelle.

My goal is to find a mutuelle that costs less than 1,423€ for premiums and orthodontic treatments for a semester for my family of four.

2. Assess the other family member needs

Getting a mutuelle plan that better reimburses orthodontics means higher premiums. Ask yourself if all dependents need a higher level of coverage.

In my case, only one of my children needs orthodontics while the rest of the family has basic medical needs. Considering that a child cannot be on his own mutuelle plan, I decided to split the family on two different plans: I and my teen (with braces) in Team A, my husband and my younger child in Team B.

3. Crunch the numbers

Use any mutuelle online comparison website (I used Les Furets) and crunch the numbers. Do not hesitate to simulate your reimbursements with different plans. I ended up switching to a mutuelle that reimburses 450% per semester on orthodontics.

My new mutuelle’s plan coverage for the entire family:

| Orthodontic cost | 970€ |

| BR | 193.50€ |

| Total reimbursements (BR * 450%) | 870.75€ |

| Out-of-pocket | 99.25€ |

| Premiums Team A (138€ * 6) | 828€ |

| Premiums Team B (51.06€ * 6) | 306.36 |

| Total expenses (Premium+out-of-pocket) | 1,233.61€ |

I have reached my goal! With my new mutuelle, I am saving €900 over five semester of orthodontic treatments and I have a great coverage.

I hope this article helped you figure out how to find the best mutuelle in France for your needs. Read Pharmacies in France to learn more about healthcare in France.

Thank you so much for these articles. Even after almost 30 years in France, there is much for me to learn in them and, of course, I can guide others to your articles. Concerning mutuelles, you gave Four Reasons to get a Mutuelle Santé. (The website did not allow me to comment directly on that article, I don’t know why). But you did not mention the cost of subscribing. A long time ago, I calculated that I would pay far more to join a mutuelle than my family would receive in benefits. (I was going to say “unless we were very sick”, but of course if you are very sick, that is precisely what Sécu takes care of.) But I am not confident in my calculation. French people are always shocked that I don’t have a mutuelle and are sure that I am reckless and playing with fire. But the examples they give (e.g. pregnancy) for why I am being reckless are always things that are covered by Sécu. I formed the theory that French people are just not well informed about how much Sécu actually covers and/or that having a mutuelle is a sign of being a responsible adult, rather than being actually necessary. I ask if they have done a cost-benefit analysis and of course they have not. But I am not at all sure that my analysis is correct. My understanding is that, since it is solidaire, your subscription fee depends on your income, so that it is rational for people with high earnings to opt out. Can you enlighten me? Thanks very much.

Thank you very much for your comment Laurette! Mutuelle’s fees are not based on your income and everybody pays the same amount. I agree with you when you say that the choice of a mutuelle should be based on calculation. I believe that a mutuelle is worth it for most people, especially for dental and optic care that is not well reimbursed by Securite Sociale. That said, if you have high earnings, I guess having to pay several thousands for a dental crown at once will not be an issue. Even though, with your needs changing, it might be a good idea to recalculate regurlarly. There are times when you need to see more specialists. In my case, my son getting braces for five semesters made me switch to a more adapted mutuelle. Another factor that makes French people not question whether thay should get a mutuelle or not is probably that this is mandatory when you are employed and employees only pay half of it, which makes it very affordable. I hope I answered your question Laurette!